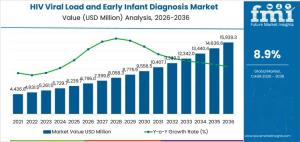

HIV Viral Load and Early Infant Diagnosis Market Projected to Reach USD 15,939.3 Million by 2036

The hiv viral load and early infant diagnosis market is projected to grow from USD 6,795.0 million in 2026 to USD 15,939.3 million by 2036, at a CAGR of 8.9%.

NEWARK, DE, UNITED STATES, January 16, 2026 /EINPresswire.com/ -- The global HIV Viral Load and Early Infant Diagnosis (EID) Market is entering a decade of robust structural expansion, with its valuation expected to rise from USD 6,795.0 million in 2026 to USD 15,939.3 million by 2036, according to the latest industry analysis. This trajectory represents a compound annual growth rate (CAGR) of 8.9%, reflecting a paradigm shift where molecular diagnostics are no longer viewed as episodic tools but as essential, infrastructure-bound healthcare assets.

As national health systems align with "treatment-as-prevention" strategies, testing volumes have become structurally linked to antiretroviral therapy (ART) coverage. Routine viral load monitoring has effectively replaced surrogate markers, serving as the primary metric for clinical decision-making, regimen switching, and the assessment of large-scale public health programs.

The Strategic Importance of Early Infant Diagnosis (EID)

A critical driver of market value is the structural anchoring of EID within maternal-child health frameworks. Because maternal antibodies can confound traditional testing in newborns, molecular diagnostic certainty is required to ensure survival outcomes.

"In the context of preventing mother-to-child transmission (PMTCT), diagnostic turnaround time is a direct determinant of pediatric survival," the report highlights. "This urgency is driving the adoption of high-sensitivity platforms that can deliver definitive results within critical developmental windows, reinforcing EID as a non-discretionary segment of the HIV care pathway."

Request For Sample Report | Customize Report |purchase Full Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-31386

Quick Stats: HIV Viral Load and EID Market (2026–2036)

• Market Value (2026): USD 6,795.0 Million

• Market Value (2036): USD 15,939.3 Million

• Compound Annual Growth Rate (CAGR): 8.9% (2026–2036)

• Leading Technology: PCR Viral Load Assays (currently holding a 54% market share)

• Fastest-Growing Market: India (projected 10.3% CAGR)

• Primary End User: Public Health Laboratories (accounting for 52% of the market share)

Segmentation Insights: PCR Assays and Point-of-Care Momentum

The market is currently categorized by three primary test-kit formats, each addressing specific logistical and clinical needs:

• PCR Viral Load Assays (54.0% Share): These remain the "gold standard" for quantitative monitoring. Their high sensitivity and reproducibility are essential for longitudinal patient management in centralized reference laboratories.

• Point-of-Care (POC) Assays (32.0% Share): This is the fastest-growing technology segment, valued for its ability to reduce turnaround times and improve linkage to care in decentralized or rural settings.

• Dried Blood Spot (DBS) Kits (14.0% Share): DBS technology is vital for resource-variable regions, facilitating sample stability and transport where cold-chain infrastructure is limited.

Global Market Dynamics: Country-Level Analysis

The expansion of testing coverage and the decentralization of diagnostic networks are creating distinct growth corridors across the globe:

• India (10.3% CAGR): Leading global growth, India’s market is propelled by the scale-up of national treatment monitoring and the expansion of decentralized lab networks in high-burden states.

• China (10.1% CAGR): Growth is driven by a systematized monitoring framework and the increasing domestic production of high-throughput molecular assays.

• Brazil (9.7% CAGR): A strong legal framework and universal access mandates ensure that viral load assessment is a standardized component of the national healthcare budget.

• United States (8.5% CAGR): Demand is supported by guideline-driven care and advanced laboratory automation, focusing on long-term viral suppression and the prevention of perinatal transmission.

Infrastructure Gaps and Operational Complexity

Despite strong demand, the market faces challenges related to operational complexity. Molecular testing platforms require stable power, specialized personnel, and consistent reagent supply chains. This "platform lock-in" means that once an instrument is placed, health systems are less likely to substitute it, creating a stable, long-term recurring revenue model for top-tier suppliers.

Competitive Landscape

The global demand for HIV molecular testing is dominated by five key players who provide the integrated hardware and chemistry necessary for national-scale programs:

• Roche Diagnostics: Leads with high-throughput platforms for centralized national surveillance.

• Abbott: Competes through scalable systems that bridge the gap between lab-based and near-patient testing.

• Cepheid: A pioneer in cartridge-based molecular platforms, enabling rapid EID and viral load results in rural settings.

• Hologic & bioMérieux: Focus on high-sensitivity assays and specialized confirmatory testing solutions.

As health systems move toward 2036, the integration of data connectivity and automated quality assurance will define the next generation of diagnostic competition.

Similar Industry Reports

HIV Antivirals Market

https://www.futuremarketinsights.com/reports/hiv-antivirals-market

Infant Transport Devices Market

https://www.futuremarketinsights.com/reports/infant-transport-devices-market

Infant Gut Health Market

https://www.futuremarketinsights.com/reports/infant-gut-health-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.